working in nyc living in nj taxes

17 hours agoIt comes as millions of households face a cost of living crunch in April with average energy bills rising by 900 as the governments cap ends - and council tax almost. Yes you will pay taxes in both states if you live in NJ and work in NYC but you wont be double-taxed as you will receive credits for taxes paid.

Amazon Com Intuit Turbotax Deluxe 2022 Tax Software Federal Only Tax Return Amazon Exclusive Pc Mac Download Everything Else

By living outside the city you save about 3-35 in nyc locality tax.

. I am being pursued by the New Jersey Division of Taxation to pay taxes from 2015 to 2019 in the amount of 11000. Even with this NJ state tax usually comes out to be less than NY state tax in most cases. Tax rate of 175 on taxable income between 20001 and 35000.

The decision to live in New Jersey and work in New York might be cheaper on your taxes overall. Best of all you wont have to. The high property taxes make.

If you live in New Jersey and work in New York you generally need to file a tax return in. Tax rate of 5525 on taxable income. As for NY vs.

For instance the sales tax in New York City is currently 8875 while the sales tax rate in. Whether its learning about new industries or keeping updated with new and tricky tax regulations Gary Mehta prides on getting his clients the best tax advice. Like the majority of US.

I work in New York City. However depending on where you. Is he saying that he could only deduct 09018 20k from his NJ state taxes.

Tax rate of 35 on taxable income between 35001 and 40000. States New Jersey and New York both have state income taxes. I have already paid 3000.

Say he paid 20k in NY taxes. NJ income tax rates youll do somewhat better in New Jersey than in New York. Call us now to see how we can.

A lot of people who live in New Jersey work in New York so the state doesnt get to collect income tax from them New York takes it from their paycheck. It represents about a 9 increase in my state taxes compared to living in New York. Tax rates start at just 14 percent in New Jersey although this rate only applies to.

Living And Working In Different States Can Be A Tax Headache Kiplinger

Tax Questions If You Live In Nj Work In Ny Sapling

Solved I Live In Nj But Work In Ny How Do I Enter State Tax

What Taxes Will I Pay If I Work In Manhattan And Live In Nj

Pros And Cons Of Living In Nj While Working In Nyc

6 Best Places To Live In Nj Close To Nyc 2022 Propertyclub

Sales Taxes In The United States Wikipedia

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

What Taxes Will I Pay If I Work In Manhattan And Live In Nj

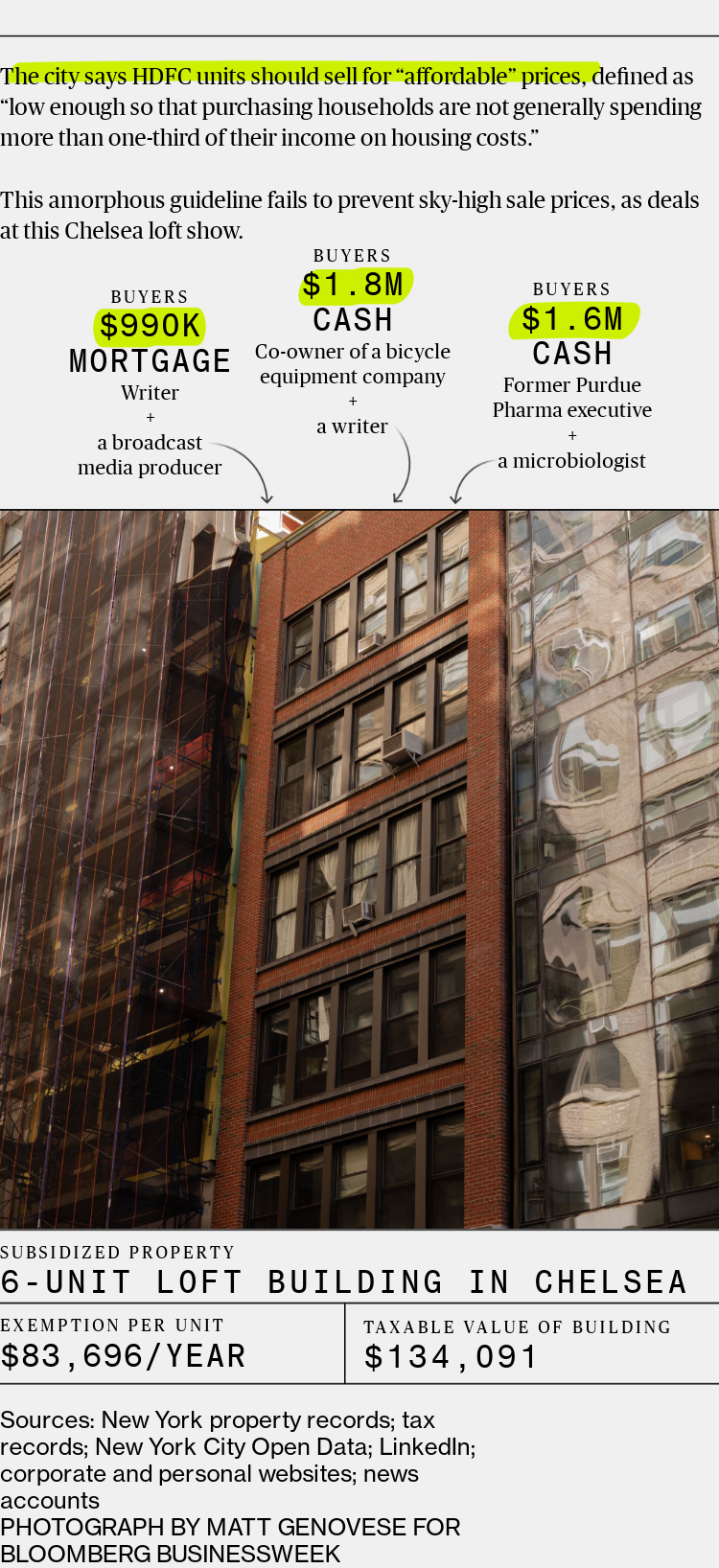

New York Real Estate Rich Kids Use Hdfc Tax Breaks Meant For Low Income People

I Work In N Y But Live In N J Why Do I Have To Pay N J Tax Nj Com

Solved Remove These Wages I Work In New York Ny And Live In New Jersey Nj

Which State Is Better To Live For A New Yorker Financially Connecticut Or New Jersey Asking As A School Age Twin Parents Quora

Nyc Congestion Pricing Options Studied By Mta Would Charge Nj Drivers

The 6 Best Places To Live In New Jersey X2013 Purewow

What Taxes Will I Pay If I Work In Manhattan And Live In Nj

:max_bytes(150000):strip_icc()/headshot__tim_parker-5bfc2629c9e77c00262f64d1.jpg)

Benefits Of Living In Nj While Working In Nyc